When One Leader Holds the Keys to Success and Survival

Exploring Key Person Risk and how visionary leaders shape, sustain, or unravel organizations.

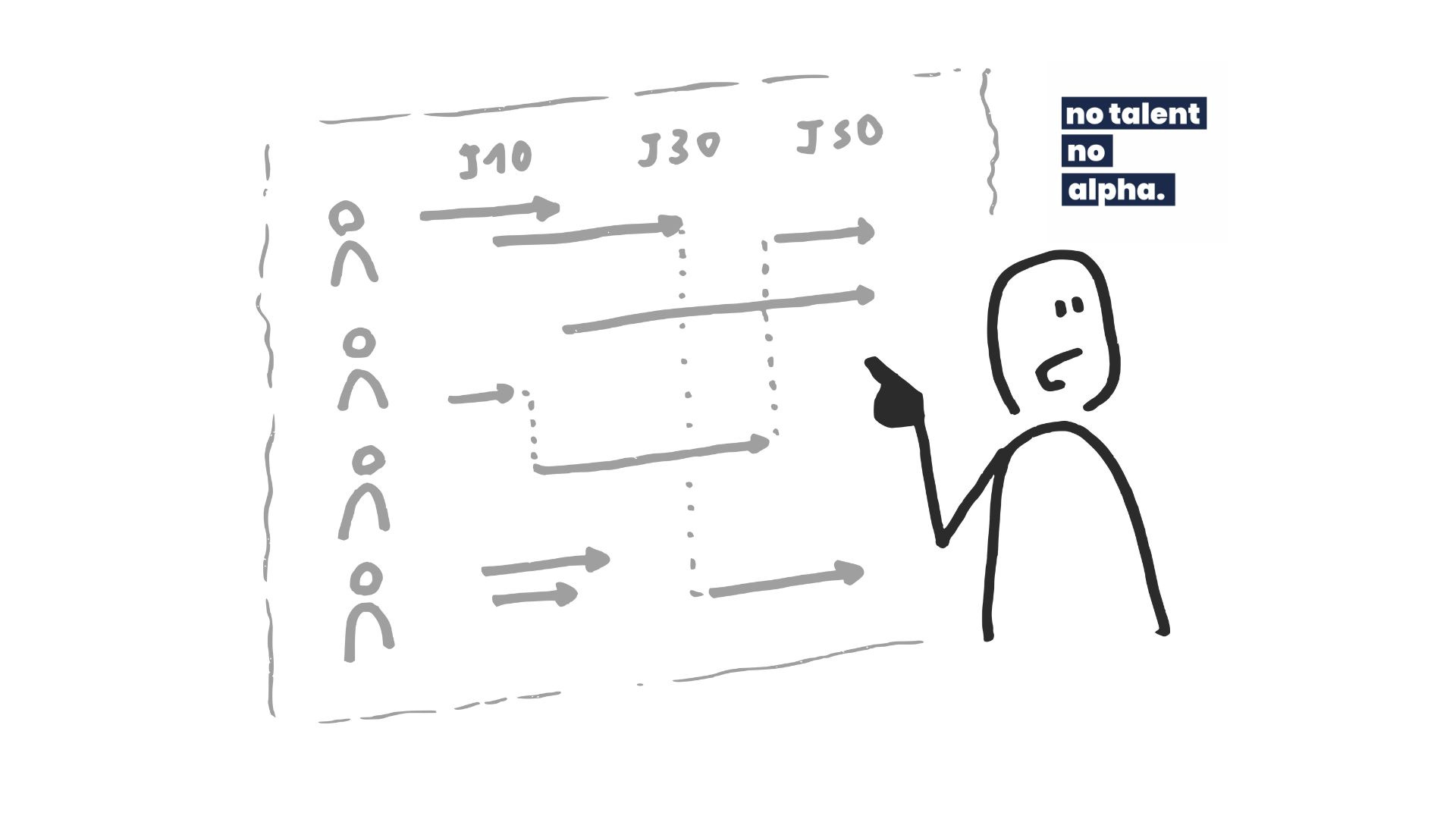

Investors love to talk about moats—those durable competitive advantages that shield a company from competition. But what if the company’s greatest advantage is tied directly to a single individual? Some leaders have such an outsized impact on execution, culture, and strategy that their departure can send shockwaves through a stock’s valuation. This is K…